Read these articles from Reuters and CBInsights to get more insights. What do you think? Is this a major disaster or a needed correction? ⛔ More startups will have to close up shop ☹️ Layoffs at startups will intensify in an effort to reduce their cash burn 👎 Propped-up valuations will be “pressured” and start falling faster, as they have in the public markets. 🕵️ Investors are becoming increasingly discerning just when startups need more access to equity funding now that debt is less of an option

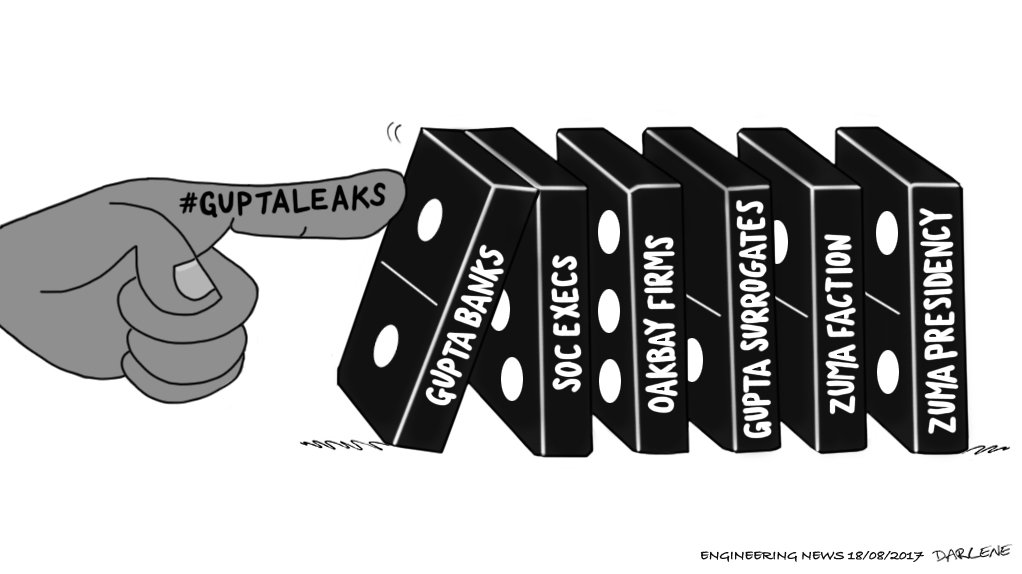

is affected in some way, all those surrounding it will do the same. 🛑 SVB unsuccessfully looked for ways to close it’s funding gap which resulted in the collapse An expression meaning that if one thing/person/etc. 💸 But cashflow gaps remained and SVB clients started pulling money out to meet their liquidity needs 🏛️ This propped up private valuations (By Q4’22, private tech valuations across most stages had fallen modestly from 2021’s heights, but were still up compared to 2020) 💰 Startups turned to venture debt, of which SBV was a large supplier, to avoid pressured valuations and downrounds 🤝 Fundraising deals slowed down (currently trending even lower than projected) 🚨 The market for IPOs shut down for many startups and made private fundraising more costly 📉 Valuations of public tech companies dropped significantly (combined market cap of the 50 largest tech IPOs since 2020 is down 59% vs.

⚠️ Investors became more risk-averse because money was more expensive

📈 Interest rates were increased to fight inflation There is a major domino effect happening that resulted in the collapse of Silicon Valley Bank (SVB) and it’s impact on the startup ecosystem is far from over: Written by our Co-founder Tessa de Flines

0 kommentar(er)

0 kommentar(er)